Earlier this month, Amazon debuted a new grocery brand called “Amazon Saver.” True to its brand name, most items are priced under $5 to help shoppers extend their grocery budget.

But beyond being a smart way to capture inflation-weary shoppers, could this be Amazon’s first move toward the low-cost product market to confront its Chinese rivals? Well, we can’t really blame Amazon since its competition has some good cards to earn a big advantage.

- Ecommerce feud: China vs. U.S. 🏅

- Walmart Marketplace’s Collectibles Experience program 🃏

- You best Prime Big Deal Days yet 🫵

HOT TOPIC

Did you know Shein and Temu are among the most downloaded apps in 2023? And nope, it’s not just because of their low-priced items or fast-moving goods.

🤺 According to a recent article from VentureBeat, the China-born marketplaces use a 3-point tactic to compete with the U.S.-based retail titans.

1. The “Super App” concept

China is known for its super apps that combine multiple services. Just look at WeChat—a messaging app, a mobile payment app, a social app, and a gaming app ALL AT ONCE!

- Why this works: Compared with fragmented U.S. platforms, an “all-in-one” app means less friction since users don’t have to jump around to complete a purchase. Plus, it acts as a customer relationship management (CRM) tool that bonds sellers and buyers at multiple touchpoints.

2. Influencer economy

Influencers are called “key opinion leaders” (KOLs) in the Chinese ecommerce industry. They focus on selling, especially live selling, and have online stores within super apps where their income doesn’t depend on likes and shares. 📳

- Why this works: Influencers in the U.S. rely on engagement of their user-generated content (UGC). The platforms they post content on decide how much they earn, making the influencer economy volatile. Chinese KOLs are more stable and can concentrate on marketing and promoting.

3. Product accessibility

China has a huge advantage in being a global production hub, having both manufacturers and suppliers at sellers’ doorsteps. On the other hand, the U.S. relies on imported goods, so getting the same product out takes longer and costs more.

- Why this works: Chinese sellers can sell more varied products at lower prices and faster delivery times.

🤫 Amazon’s secret strategy

Just like a good ‘businessman,’ Amazon takes notes from China’s ecommerce success. The platform isn’t a super app, but it has been forging meaningful partnerships with other tech companies. For example, Facebook users can buy from Amazon without leaving the social app.

But do you think it’s a great idea for U.S. retailers to adopt more of China’s tactics? Let us know your thoughts by replying to this email! ✉️

TOGETHER WITH WALMART MARKETPLACE

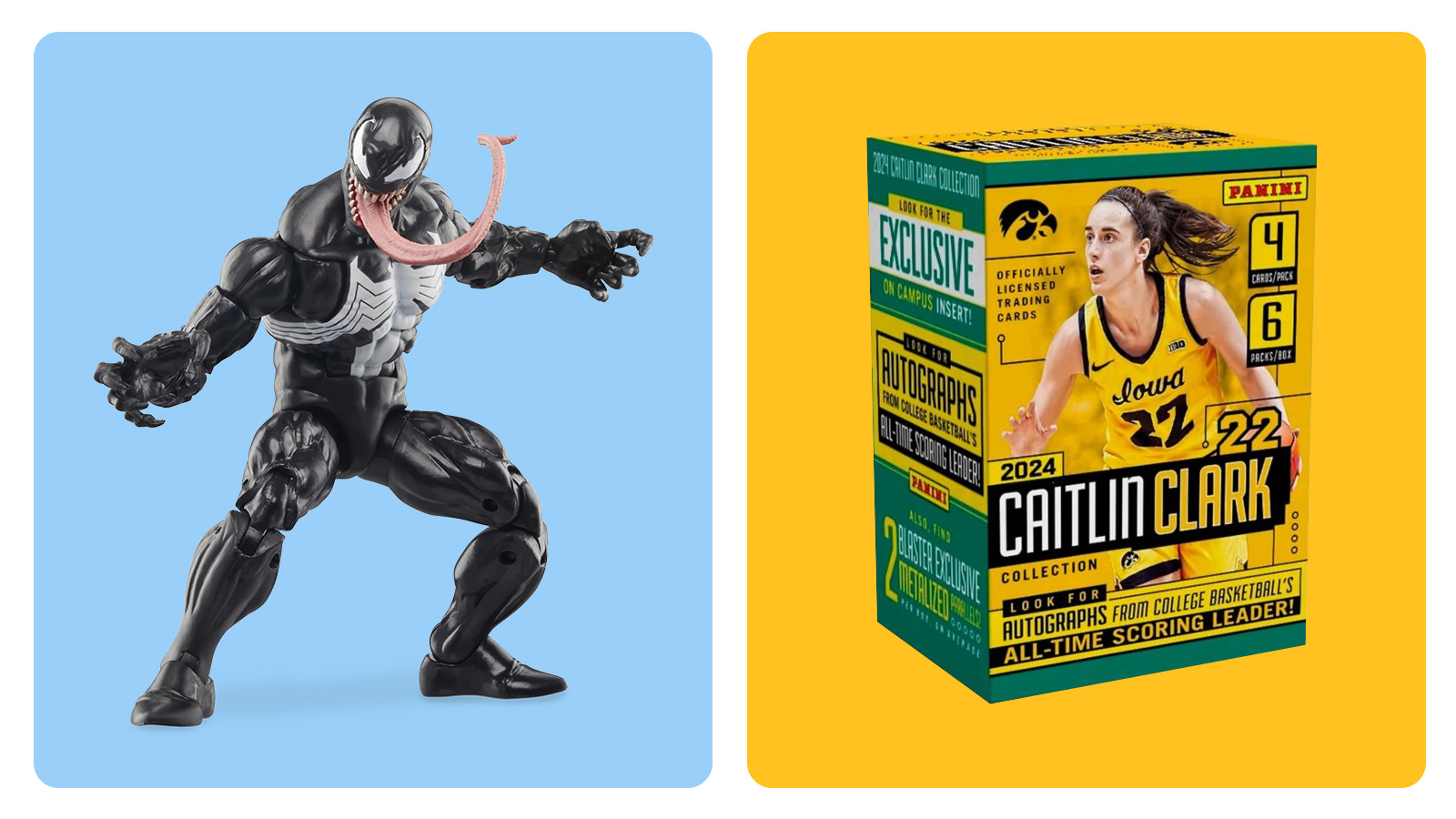

Looking to stand out in the market? Join Walmart Marketplace’s Collectibles Experience program

Do you sell in the Trading Cards, Sports Memorabilia, Toys, Comic Books & Books, Media & Music, and/or Coins categories? Then, you could be a great fit for our Collectibles Experience!

Through our limited-time referral fee offer, sellers specializing in collectors’ items will have the chance to enjoy 0% referral fees until October 31, 2024, plus additional perks!

Additional perks for sellers in the Collectibles Experience include:

- Select a return policy that works best for your business. Choose between accepting: no returns, a 15-day return with sealed policy, or our standard 30-day Walmart return policy.

- Offer preorders*. Build anticipation around a new drop by offering pre-orders for your products.

- List trading cards and comic books with new, graded condition options. Our new grading system displays your collectibles in mint and other great conditions.

- Mark items as pre-owned*. Collectibles come in all conditions. Let your customers know that your products are vintage and pre-loved, making them one-of-a-kind.

Learn more and sign up to sell on Walmart Marketplace today.

BITES OF THE WEEK

- Shooting for Success: Here are 7 steps to shoot effective product videos.

- Free and True: TrueGether is set to revolutionize ecommerce with its "no-fee" marketplace!

- Selling in EU: Did you know FBA sellers are automatically enrolled in the European Export Programme?

AMAZON NEWS

How to make the most of Amazon’s Prime Big Deal Days

Amazon sellers are gearing up for the October "Prime Big Deal Days," but many are skeptical about its impact on holiday sales.

🛍️ According to Modern Retail, the October Prime event may not make waves for sellers due to:

- Lower sales volume. Last year, the fall Prime Day saw 150 million items sold, far fewer than the 375 million sold during the summer Prime Day.

- Being just a minor move. Brands are using it to offload excess inventory and prep for Black Friday, rather than aiming for massive sales.

- Shoppers’ behavior. Many customers wait for November's holiday deals, making October less of a profit driver.

🎯 So, how do you prime your business for success?

You may not expect massive sales, but here are some smart strategies to make the most of this event:

- Clear out excess inventory. Many brands use the October sale to offload stale inventory before the holiday rush.

- Test holiday strategies. Experiment with discounts and customer preferences to learn what works ahead of Black Friday.

- Offer lighter promotions than the summer Prime Day to avoid cannibalizing holiday sales.

- Optimize your listings to improve your sales even without running hefty deals.

Amazon’s fall Prime Day sale might not bring in the big bucks like its summer counterpart, but it’s still a valuable opportunity to earn more. Our tip? Use this event as a stepping stone toward Black Friday and beyond. 🪨