Think you know your Amazon fees?

This seller and others in the thread thought so too, until it turned into a full-on “fee therapy” session exposing every way the platform eats into profits.

- Your profit calculator is lying to you 🕵️

- Amazon may be milking you for no reason 🐄

- Thought of the Day 🍴

SELLER CONFESSIONS

An Amazon seller (OP) confessed: They knew Amazon had fees, but they didn’t realize they’d accidentally signed up for the premium, extended, director’s-cut edition.

What started as a simple vent turned into a full-on “fee therapy” session about just how many ways Amazon can charge sellers before they even see a profit.

Sellers fired off the usual suspects:

- Referral fees are Amazon’s cover charge for existing.

- Storage fees are the rent.

- Long-term storage fees are the rent, but meaner.

- Removal order fees are paying Amazon to hand your own items back.

And for OP, that’s barely scratching the surface. One seller joked, “At this point, I’m waiting for the ‘breathing inside the warehouse’ fee.”

⚠️ The low-inventory curveball

Another sticking point: the low-inventory fee, triggered by storage utilization ratio, not sell-through. Yep, another metric to babysit.

- Avoiding charges: Seasonal and wholesale sellers asked how to dodge penalties for items not stocked year-round or discontinued.

- What experts advise: Close or remove listings that shouldn’t trigger the fee, Amazon only sees low stock, not the reason behind it.

But under all that, the thread circled one uncomfortable question: Is Amazon charging for value… or simply because it can?

🔦 Amazon crossing the line

As the discussion deepened, sellers split into two camps:

- Platform power imbalance. Some argued Amazon’s “pay-to-play” model has gone too far, charging to list, store, fulfill, advertise… and now understock.

- Visibility as a second paywall. Others said running ads just to appear in search, despite paying the standard fees, feels like double taxation.

Yet the counterargument still showed up: the marketplace’s massive reach offsets the sting if sellers treat fees as a non-negotiable cost of doing business.

🧭 Is it still worth it?

Even with all the frustration, most agreed on one thing: Amazon isn’t cheap, but the scale is unmatched. The trick is surviving the fee maze long enough to actually benefit from it.

For sellers who can manage the math, Amazon pays.

For those who can’t, the fees make that very clear, very fast.

TOGETHER WITH THREECOLTS

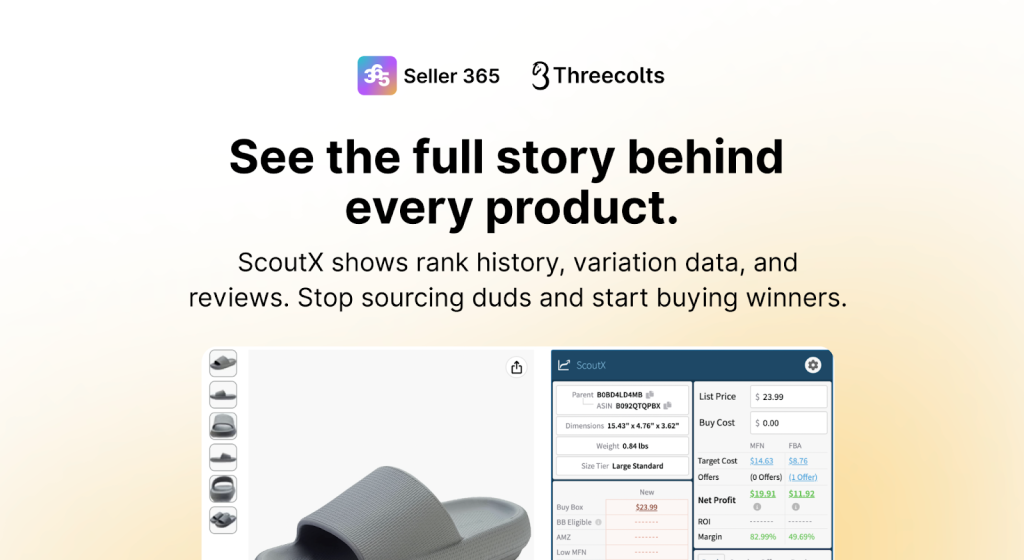

Your Amazon “profit calculator” is still letting you buy duds

You're using a simple calculator. It says a product is "profitable." You buy 50 units.

A month later, none have sold.

Why? Because your simple calculator didn't show you the full story.

It didn't show you that the BSR is a 1-day spike.

It didn't show you that one variation gets 99% of the sales (and you bought the wrong one).

It didn't show you the 1-star reviews screaming "will be returned."

Seller 365's ScoutX Profit Calculator is a complete data widget.

It's not just a profit calculator. It shows you the sales rank history and price history over time, product variation data, and reviews.

Plus, you can export all the data into Google Sheets to create a buy list—all in one place—so you can stop sourcing duds.

Stop sourcing blindly. Get the full story on every product.

THOUGHT OF THE DAY

When you know your numbers, even the steepest fees lose their power.

BITES OF THE WEEK

- Global Growth Boost: Amazon and AEPC host a workshop to guide sellers on scaling ecommerce exports worldwide.

- Future-Ready Sellers: Free Wizards of Ecom meetup shares 2026 Amazon predictions and community insights to prep brands.

- Lead List Mastery: This guide teaches sellers, especially online arbitrage sellers, to turn lead lists into profitable sourcing systems.

- Embracing the AI Era: Shopify and Yotpo reveal how AI reshapes discovery, PDP structure, trust signals, and visibility through GEO.