Happy Monday!

We have an exciting announcement today: Canada’s first and largest dedicated ecommerce conference is all set and coming soon! Not only can you learn about how to craft winning strategies, you’ll also get to hear inspiring stories from the largest names in the industry!

We’re gonna unravel more details about this event soon, but how about we unravel the hottest ecommerce news first?

- Canceled holiday fee 💸

- Sales-boosting marketing 📈

- Inventory-to-sales ratio ➗

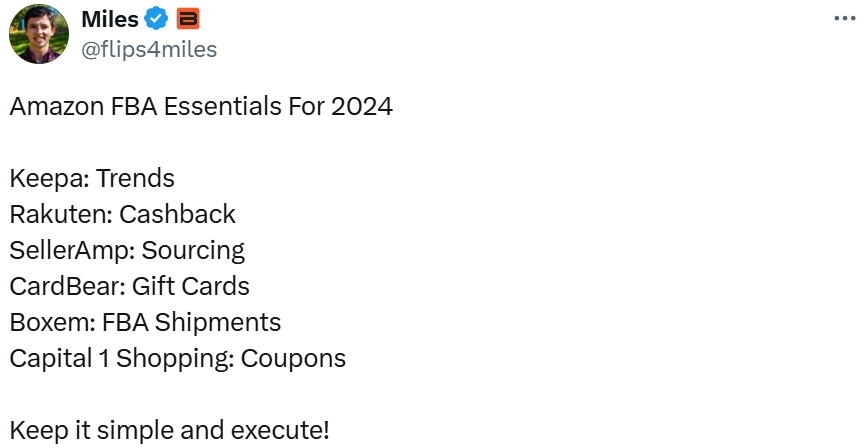

POST OF THE WEEK

AMAZON NEWS

Remember the holiday inventory deadlines we listed last week? Well, here’s a quick and important follow-up: Amazon also announced updated fulfillment fees for the peak season!

Holiday peak fulfillment fees are an annual thing and will apply from October 15, 2024 to January 14, 2025. But the most important—and probably the best—thing to know is that there’ll be no overage fee this holiday season! 🎉

Yahoo! Finance reposted Fortune’s breakdown of the announcement and what it means to sellers.

💲 What’s the overage fee, again?

Sellers have inventory storage limits in size (cubic meter) and duration of storage (usually 90 days of stock). The overage fee is like a penalty imposed on those who exceed these limits, regardless of the reason.

The lowest surcharge is $0.50 per cubic meter, which applies to products unsold for 181 to 210 days; the longer the stock is stored, the higher the cost.

Going back to the announcement, here are the clarified terms:

- The fee cancellation applies to U.S. FBA sellers.

- The cancellation will be retroactive to July 1, 2024. If you were charged for July, you can get some of your money back (contact seller support to know the process).

- Other seller fees still apply, including excess inventory and the low-inventory-level fee.

But why is Amazon removing the surcharge?

According to Amazon VP, Dharmesh Meta, they "hope this will help more sellers ensure they have enough inventory ready for peak demand this holiday shopping season."

Peak season is tricky as some inventory will sell out quicker than others. Removing the overage fee will help sellers keep their bestsellers in stock in time for the holiday rush.

📖 To further ensure your holiday readiness, read the FBA peak readiness playbook for the complete timeline, tools, and tips.

TOGETHER WITH LEVANTA

Boost your earnings with affiliate marketing

Project your potential earnings from affiliate promotions with the new Affiliate Marketing Revenue Lift Calculator. Designed for Amazon sellers, this tool helps you estimate the revenue boost you can achieve during Prime Day by leveraging affiliate marketing.

- Free forecast: Get a product category projection of your Prime Day earnings and the surrounding month.

- Data-driven: Uses benchmarks from thousands of successful brands during Prime Day.

- Boost earnings with affiliate marketing: Attract high-quality traffic, pay only for sales, and boost your chance to get the Best Sellers Rank. Plus, benefit from Amazon's 10% Brand Referral Bonus.

Sample forecast for a pet supply brand sold on Amazon:

Request your FREE forecast now

BITES OF THE WEEK

- Prime Priority: Advertisers can now run fixed-CPM, guaranteed delivery campaigns on Prime Video

- Predicting Conversions: Modeled conversion reports are now available to address third-party cookie phase-out.

- Page Promotions: Pick products to advertise and Amazon will create a new landing page.

SELLER REFRESHER

How to calculate your inventory-to-sales ratio (and why you should do it)

With the holidays fast approaching, you've likely read tips for boosting your stock levels to meet demand. But here’s another crucial tip: pay attention to your inventory-to-sales ratio, too!

Amazon defines the inventory-to-sales ratio as “a metric that measures the amount of inventory you have compared to the number of orders being fulfilled.” In short, it compares how much stock you have versus how much you’re selling.

🧮 So, how do you calculate it?

Just divide your average inventory value by your net sales over a specific period:

Inventory-to-sales ratio = Average inventory value/Net sales

For example, if your inventory is valued at $1,000 and you made $4,000 in sales, your ratio is 0.25.

Generally, it’s recommended to aim for a ratio between 0.167 and 0.25. This value is considered a balanced one, which means you have just enough inventory to meet demand without overstocking.

- A very large ratio might indicate excess inventory, leading to higher storage costs and tying up your cash.

- A very low one means you could run out of stock and miss out on sales.

But your ideal ratio depends on your business’s health and may change over time. So, you should track it regularly to find what works best for you.

🎄 Why does it matters for the holidays?

With more orders coming in, it’s possible to either overstock or run out of popular items. Keeping a close eye on this ratio will help you optimize your inventory levels and make sure you don’t miss out on those crucial holiday gains.